Are we facing a new stagflation?

In the past few months, economic concepts such as inflation, expensiveness and purchasing power that for decades have been relegated to the back burner, have re-emerged at the top of the political agenda. These were the concepts that were dominant in the political life of the capitalist world from the 1970s up until the first half of the 1980s. In Greece they were not a major concern until the mid-1990s.

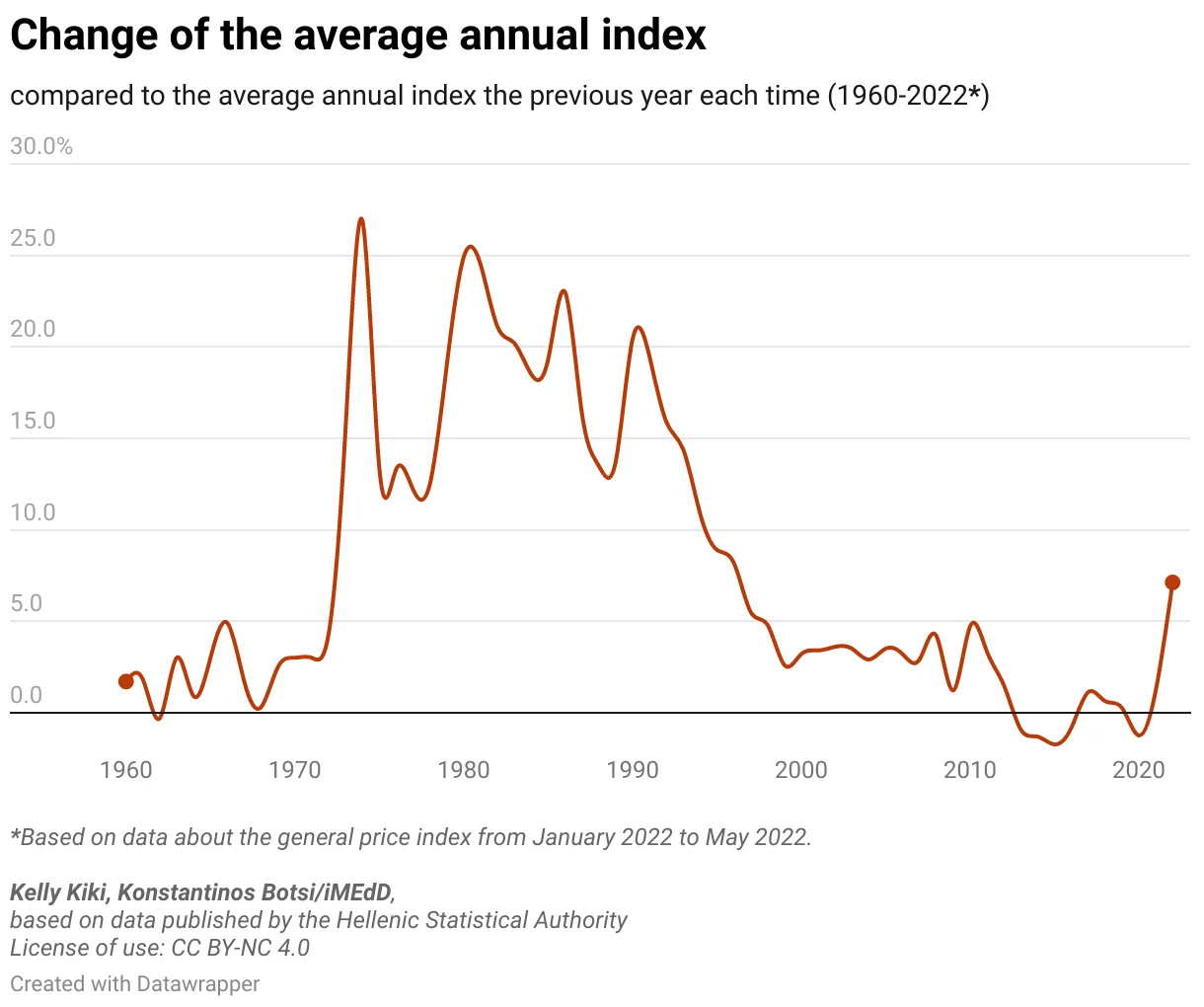

The war in Ukraine, the economic sanctions, the skyrocketing prices of energy and raw materials, along with supply chain dysfunctions after the lockdowns have led to the biggest inflation increase in recent decades, as well as a significant slowdown in growth. According to data published by Eurostat on 1 July, inflation was at 8.6% 1 in June, while Greece’s 12.1% is the highest inflation rate since 1993. 2

Inflation in Greece 1960-2022, Source: IMED LAB. Source: iMEdD Lab

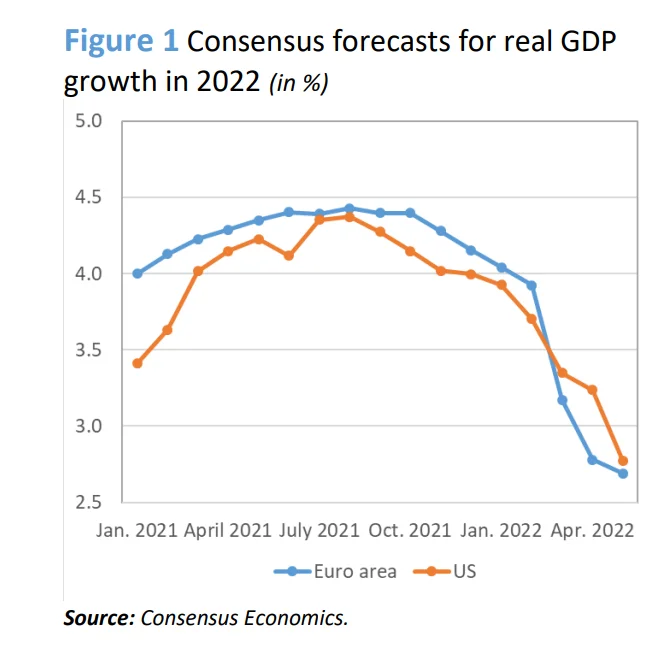

The World Bank’s forecast for 2022 global growth was slashed to 2.9%, down from 5.7% in 2021. Professor Adam Tooze, one of the world’s most influential and renowned economists, stated that this is the sharpest deceleration in a post-recession recovery in 80 years.3 Real economic growth in the European Union is now expected to fall below 3% in 2022, down from the 4% estimated by the European Commission before the war.4

GDP growth forecasts in the EU and the US, Source: European Investment Bank

The new economic condition that seems to be emerging has brought back into the spotlight the concept that characterised the 1970s, that is, stagflation, i.e. the combination of economic stagnation and steep price increases. 5

Valentina Romei and Alan Smith wrote in an article published in the Financial Times 6 that the more commonly cited parallel is the 1970s , when the Arab oil embargo helped create a prolonged period of economic hardship. Inflation surged to double-digit rates even as economies around the world stagnated — a painful mix of high prices and low growth known as “stagflation”.

According to Romei and Smith: “Now, stagflation is again on the cards. After the double shock of Covid-19 and the Russian invasion of Ukraine, inflation rates have exceeded expectations, surging to the highest levels in decades in many countries, while economic growth forecasts are rapidly deteriorating”.

The World Bank in its annual report on Global Economic Prospects 7 talks of an increased stagflation risk: “Russia’s invasion of Ukraine and its effects on commodity markets, supply chains, inflation, and financial conditions have steepened the slowdown in global growth. One key risk to the outlook is the possibility of high global inflation accompanied by tepid growth, reminiscent of the stagflation of the 1970s. This could eventually result in a sharp tightening of monetary policy in advanced economies, which could lead to financial stress in some emerging markets and developing economies”. It is indicative of the importance of this issue that the report contains 28 pages on Global Stagflation alone.

Back to Greece, the Labour Institute of the General Confederation of Greek Workers’ (INE-GSEE) annual report on the Greek Economy and Employment 8 states that the Greek economy is also facing stagflation risks. According to the report, “The combination of the effects of the pandemic crisis and, more importantly, of the inflationary shock on the macroeconomic system, as well as the effectiveness in managing them, will determine to a significant extent the economy’s prospects for the period 2022-2023. It is very important for the country’s political economy to avoid any risk of being trapped in stagflationary conditions. Such a development would increase not only the economic, but also the political and geopolitical risk for Greece.”

Stagflation in the 1970s

In the late 1960s and early 1970s the economies of the capitalist world began to falter. It was not immediately understood at the time, but the “Golden Age” of the West, that is, the era of rapidly rising living standards, full employment, low inflation, powerful welfare states, class compromise between capital and labour, and the application of Keynesian theories, had come to an end. In retrospect, the period between the end of the war and the crisis of the 1970s could be described as unique in history, as the great Eric Hobsbawm says. 9

David Harvey describes in broad terms the situation that had arisen: “Signs of a serious crisis of capital accumulation were everywhere apparent. Unemployment and inflation were both surging everywhere, ushering in a global phase of ‘stagflation’ that lasted throughout much of the 1970s. Fiscal crises of various states (Britain, for example, had to be bailed out by the IMF in 1975–6) resulted as tax revenues plunged and social expenditures soared. Keynesian policies were no longer working”. 10

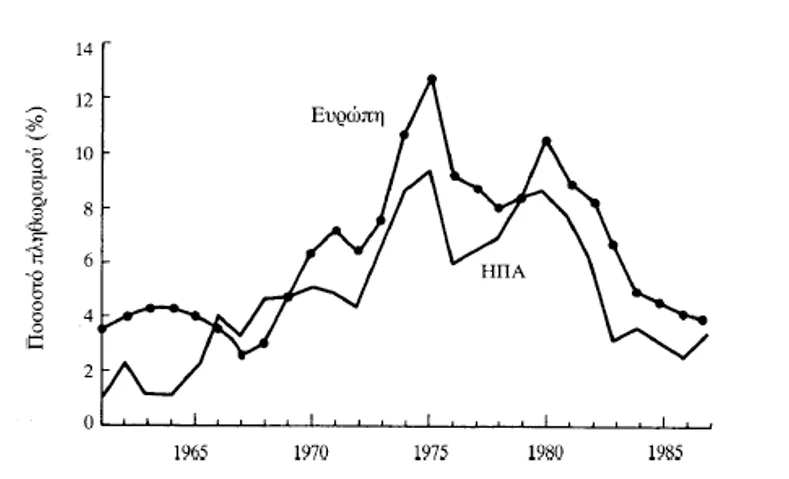

According to the World Bank’s report,11 Global consumer price inflation rose steadily in the 1970s, starting from a range of 1.7-4.4% a year through the 1960s and early 1970s. In 1973, inflation surged to 10.3%, when the first oil price shock struck. Inflation then rose steeply through the remainder of the 1970s and stayed elevated until the global recession of 1982. As a result, global inflation during 1973-83 averaged 11.3% a year, more than three times as high as the average of 3.6% a year during 1962-72. During this period, however, there were marked differences across countries.

[CHART: INFLATION RATE % // Europe/ USA], Source: David Harvey, A Brief History of Neoliberalism

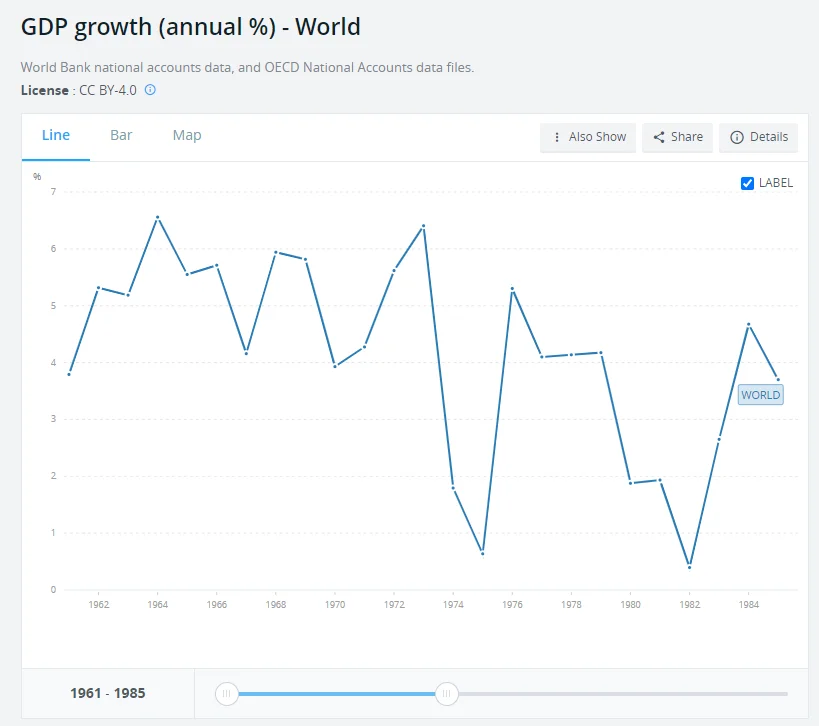

After two decades of robust global growth in the 1950s and 1960s, the 1970s were a period of sharply slowing global growth. The decade was marked by a global recession in 1975 and three recessions in the United States (1969-70, 1973-75, 1980). Overall, global growth in the 1970s averaged 4.1% per year, well below the 5.5 and 5.1%, respectively, of the 1960s and 1950s. 12

Global economic growth 1961-1985, Source: Data Worldbank

However, we should distinguish the concept of stagflation from that of economic crisis. Hobsbawm wrote on that subject that the Decades of Crisis after 1973 did not constitute decades of “Great Depression” in the sense of the 1930s or compared to the decades after 1873, although they were described as such at the time. The world economy did not collapse, not even for a moment, although the Golden Age ended in 1973-1975 in what resembled a classic cyclical recession, which reduced industrial production in the “advanced market economies” by 10% in one year and international trade by 13%. In the developed capitalist world, of course, economic growth continued, although its rate of increase was now significantly lower than what it was during the Golden Age, except in some (mainly Asian) NICs (Newly Industrialised Countries), which only started their industrial revolution in the 1960s.13

The oil embargo and the crisis of Keynesianism

It is generally considered that the period of stagflation was triggered by the oil shock of 1973. While the Yom Kippur Arab-Israeli war was unfolding, the Arab oil ministers assembled in Kuwait on 16 October 1973. 14 They decided to immediately increase the oil price by 70% from $2.9 to $5.2 per barrel. They also decided to reduce production by 5% until the Israelis withdraw from the occupied Arab territories, and to impose a gradual oil embargo on industrialised countries that support Israel, such as the USA and the Netherlands. Within six months the price of oil quadrupled, shocking the world economy and triggering an inflationary explosion.

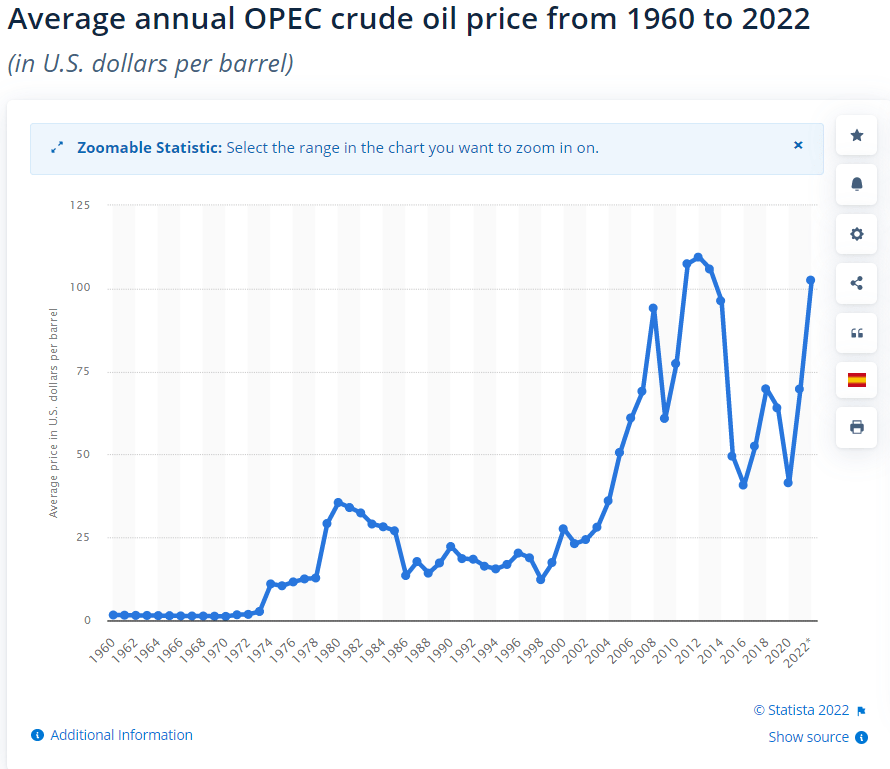

Crude oil price in OPEC countries ΟΠΕΚ 1969-2022, Source: • Oil prices 1960-2021 | Statista

However, signs that the Keynesian model was not working had surfaced earlier. In August 1971, President Nixon decided to end the immediate dollar convertibility to gold ($35 an ounce), effectively dissolving the Bretton Woods system of fixed exchange rates on which the post-war capitalist economy was founded.15 By June 1973 the dollar had lost 19% of its value.

In fact, Andrew Glyn’s estimate seems accurate: “The very success of the ‘Golden Age’ seemed to have undermined its basis. It brought extended full employment and thus the strengthening of labour; high demand for energy and other materials was pressing against available supplies. Europe and Japan were catching up with the USA thus disturbing international economic relations; productivity growth appeared to be running out of steam as the potential of existing technologies was used up”.16

The stagflation dilemma

The way the 1970s stagflation was dealt with changed the course of history and shaped the context within which economic policy still unfolds to this day. Stagflation was a great opportunity to impose on a global scale the neoliberal model of absolute market freedom, privatisation, the dismantling of the welfare state and the weakening of trade unions.

The course that things have taken was not a foregone conclusion from the beginning. Initially, governments were faced with the “stagflation dilemma”.17 One option was to stick to an expansionary fiscal policy with low interest rates and large deficits, which would allow full employment to be preserved but could lead to even higher inflation. The other option was to adopt recessionary policies with high interest rates and low deficits, which would harness inflation but skyrocket the unemployment rate. The dilemma was resolved in the US where both the FED and various US administrations (starting with the Carter presidency) deemed inflation to be more important than unemployment.

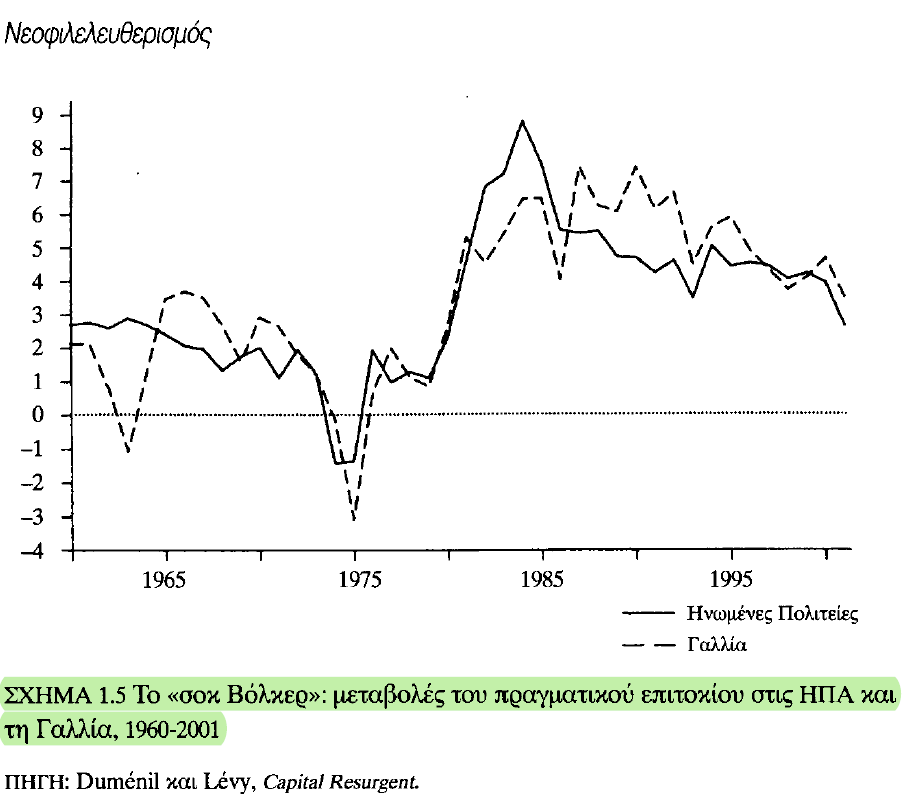

The change of course was marked by the decision of the FED chairman Paul Volcker to raise US interest rates in 1979 to unprecedented levels (Volcker Shock). Between early 1979 and mid-1981 short-term interest rates doubled, reaching 19.1%.18 Inflation dropped from 13% in 1980 to 3% in 1983 but at the price of a surge in unemployment from 5% in 1979 to 10% in 1982. The sharp rise in US interest rates caused the debt crisis of a number of developing countries, including Mexico.19

[GRAPH: NEOLIBERALISM// US/ FRANCE// Figure 1.5 The ‘Volcker shock’: movements in the real rate of interest, US and France, 1960–2001, Source: Duménil and Lévy, Capital Resurgent

Source: David Harvey, A Brief History of Neoliberalism, Oxford University Press]

In order to grasp the change in priorities that has taken place in the context of dealing with stagflation, it suffices to say that the leading American Keynesian economist John Kenneth Galbraith argued that the primary goal of economic policy should be “the avoidance of depression and the prevention of unemployment”.20

The priority of reducing inflation over unemployment, and tackling stagflation with restrictive policies, was not just an economic choice, but a predominantly political choice that was directly linked:

- To a plan to redistribute wealth in favour of the elite. “After the implementation of neoliberal policies in the late 1970s, the share of national income of the top 1% of income earners in the US soared, to reach 15 per cent (very close to its pre-Second World War share) by the end of the century. The top 0.1% of income earners in the US increased their share of the national income from 2 per cent in 1978 to over 6% by 1999, while the ratio of the median compensation of workers to the salaries of CEOs increased from just over 30 to 1 in 1970 to nearly 500 to 1 by 2000.”21

- To the credibility of the neoliberal worldview shaped by intellectuals such as Friedrich Hayek and Milton Friedman, as well as institutions such as the Chicago School of Economics and the Mont Pelerin Society. A worldview that appeared to be able to provide answers where Keynesianism seemed to miss the mark.22

Then and now

What is different and what remains the same if we compare the current situation to that of the 1970s? The World Bank report lists them in the context of its own choices, which are in line with the current neoliberal orthodoxy. Nevertheless, they’re an interesting read.23

Similarities to the 1970s

- Supply shocks after prolonged monetary policy accommodation.

Supply disruptions driven by the pandemic and the recent supply shock dealt to global energy and food prices by Russia’s invasion of Ukraine resemble the oil shocks in 1973 and 1979-80. The 1970s witnessed the largest energy and food price shocks of the past fifty years. Price increases between April 2020 to March 2022 were the second largest for energy and third largest for food for any equivalent period since 1970. Global real interest rates averaged -0.5% over both the 1970-1980 and the 2010-2021 periods.

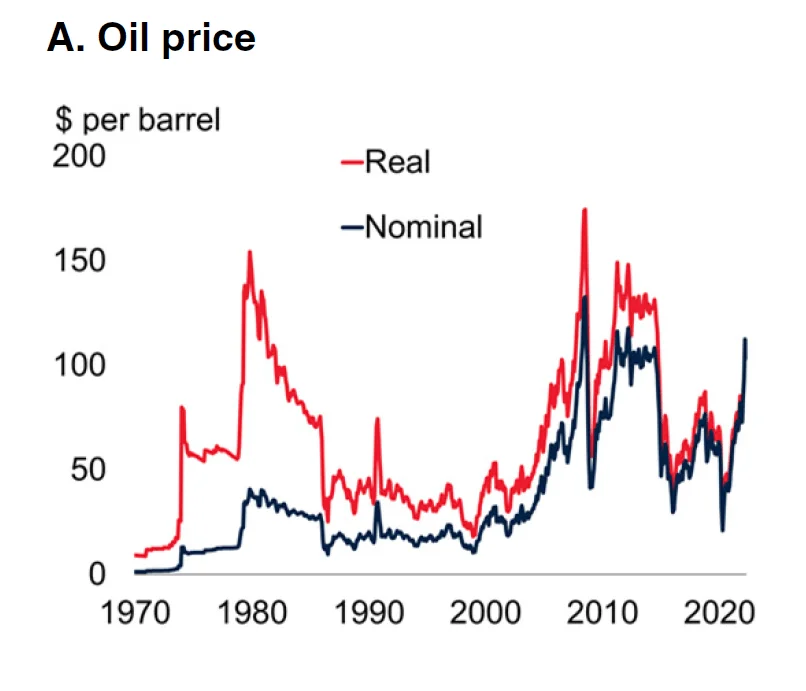

Oil price 1970-2020, Source: The World Bank, Global Economic Prospects

Nominal and real crude oil prices (averages of Dubai, Brent, and WTI prices)

- Weaker growth

The global economy has been emerging from the pandemic-related global recession of 2020, just as it did during the stagflationary period after the global recession in 1975. Between 2021 and 2024, global growth is projected to slow by 2.7%, more than twice as much as between 1976 and 1979. Over the 2020s as a whole, potential global growth is expected to slow 0.6 percentage point below the 2010s average. This structural weakening would resemble the prolonged growth slowdown during the stagflation of the 1970s. For comparison, annual average global growth slowed by 1.2 percentage points between the 1960s and 1970s.

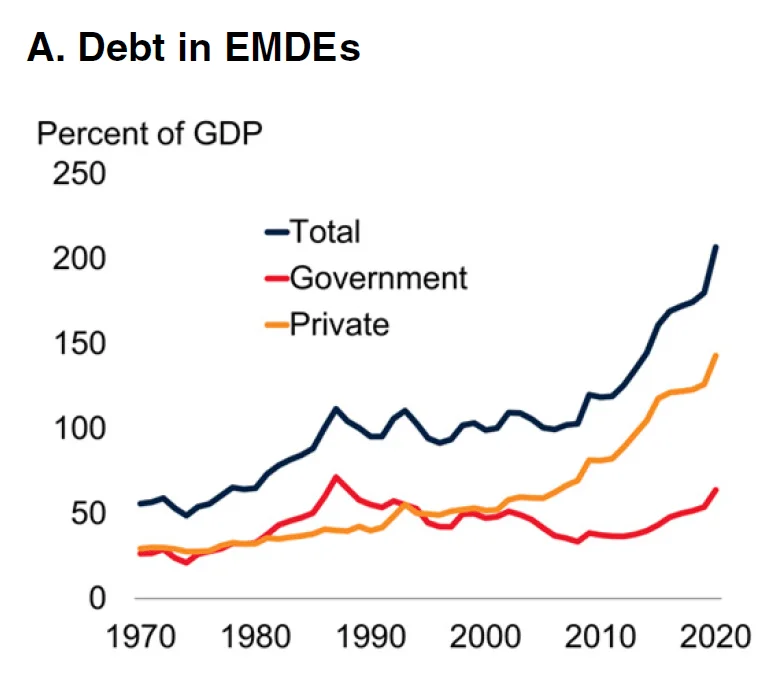

- Significant emerging market and developing economy (EMDE) vulnerabilities

The stagflation of the 1970s coincided with the first global wave of debt accumulation of the modern era. In Latin America, total external debt rose by 12 percentage points of GDP over the course of the decade while, in Low-Income Countries (LICs), it rose by 18 percentage points of GDP. This is the most broad-based increase in government debt by EMDEs in the past 50 years. A number of LICs are already either in or near debt distress. A monetary policy tightening among major advanced economies, raises the spectre of a renewed series of financial crises in EMDEs.

EMDEs’ debt from 1970s till today Source: The World Bank, Global Economic Prospects

A note regarding Sri Lanka and the debt crisis

It could be argued that the dramatic developments in Sri Lanka constitute the first major developing country debt crisis of the kind the World Bank has been warning of. Sri Lanka’s public debt is projected to have risen from 94% in 2019 to 119% of GDP in 2021.24 It should be noted, however, that Sri Lanka’s economic problems are not linked solely to the current global economic slowdown, but also to the collapse of tourism (the country’s main source of income) due to the pandemic, as well as the tax cuts the government had made in 2019.25

The issue of a possible EMDE debt crisis was brought up in the discussion between Gabriel Sakellaridis and Adam Tooze at Eteron’s event at the Delphi Economic Forum in April. Tooze had estimated at the time that a new debt crisis would be smaller in scale than that of the 1980s, but could affect the lives of 500-700 million people.

Differences from the 1970s

- Smaller shocks

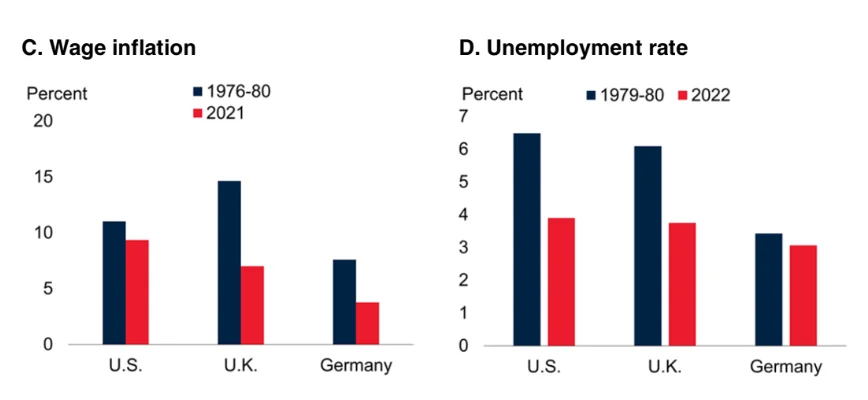

The World Bank notes that at least thus far, the magnitude of commodity price jumps has been smaller than in the 1970s. In the wake of the two major oil crises, oil prices quadrupled in 1973-74 and doubled in 1979-80. As of May 2022, oil prices have roughly tripled from their lows of early 2020, but to a level that is still only about two-thirds of those in 1980. Core inflation (inflation minus energy and food) has remained relatively low in most countries. So there is hope that if the supply chain malfunctions are addressed, inflation could be contained. However, the World Bank points out that the rate of unemployment is lower now than it was at the end of the 1970s implying potentially even larger wage and price pressures – here it is clear how the choices of the 1970s have shaped the framework of modern economic policy.

Inflation linked to wages and the unemployment rate during the stagflation era and today. Source: The World Bank, Global Economic Prospects

- More credible monetary policy frameworks

At this point the imprint of the deflationary decisions of the late 1970s is even more apparent. The World Bank considers it very important that there is no longer a wavering in priorities between tackling inflation and supporting employment. Across all countries, price stability is a top priority. It also sees the central banks’ independence as a key factor, since this means that they are not subject to political pressures – that is, they can swiftly implement socially unpalatable policies.

- Better-anchored inflation expectations

As a result of improvements in policy frameworks and better anchored inflation expectations, inflation—in particular core inflation—has become much less sensitive to inflation surprises. Since inflation can be projected more accurately, it can be dealt with more efficiently.

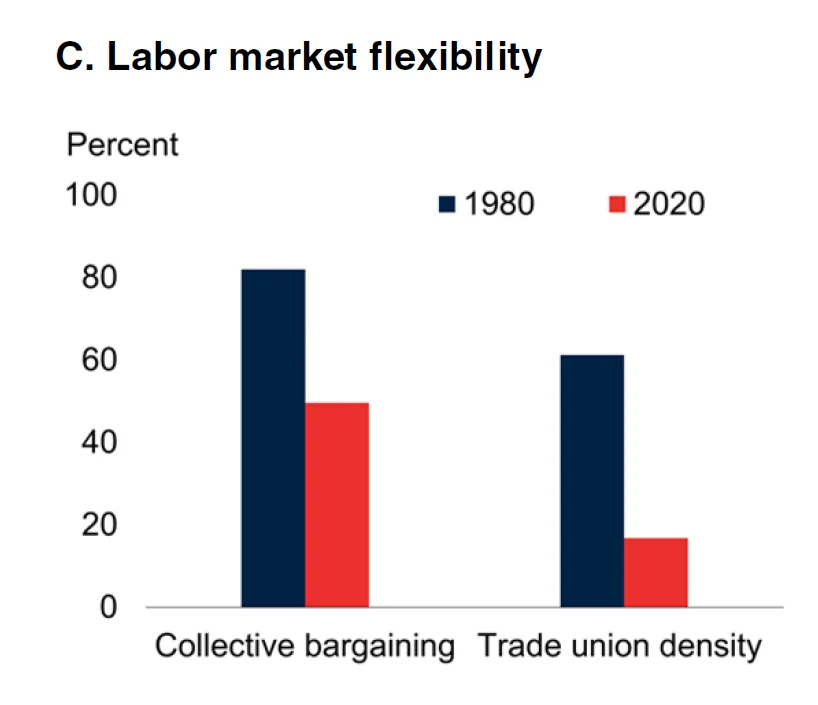

- More flexible economies

The World Bank considers as a significant development the fact that some considerable “structural economic rigidities” that existed during the 1970s have since dissipated, meaning that now the dominance of neoliberal policies is undisputed. A characteristic example of “rigidity”, according to the World Bank, is collective bargaining. In the 1970s, in the average OECD country, collective bargaining covered four-fifths of employees, while by 2020, the percentage was reduced to 50%. Additionally, the World Bank sees the fact that product market regulations have eased as a major positive development. Lastly, it notes that in advanced economies and EMDEs, energy efficiency has increased and oil dependency has decreased since the 1970s.

Labour market flexibility 1980-2020 (Percentage of employees covered by collective bargaining and trade union density) Source: The World Bank, Global Economic Prospects

- Less fiscal accommodation

The 1960s and 1970s were marked by expansionary fiscal policy. In contrast, in the coming years, fiscal policy tightening is expected to be implemented. It is estimated that by 2023, 2/3 of the advanced economies will withdraw all the supporting measures that they had implemented during the pandemic, which averaged 29% of GDP. This is likely to constitute a major brake on demand growth and help moderate price pressures.

The warnings about recessionary policies

In a recent article published in the New York Times,26 the Nobel prize-winning economist Paul Krugman appears to be optimistic about the prospects of the US economy. Krugman states that “a growing accumulation of other data, from rents to shipping costs, suggest that the risk of stagflation is receding. That’s good news”. On the other hand, he’s concerned because “policymakers, especially at the Federal Reserve, may be slow to adapt to the new information. They were clearly too complacent in the face of rising inflation (as was I!); but now they may be clinging too long to a hard-money stance and creating a gratuitous recession”.

Krugman argues that the markets believe that inflation will not last, while the Fed seems to be taking the opposite view and leaning towards something more than a slowdown in the economy.

Nobel laureate in economics, Joseph E. Stiglitz and Dean Baker, Co-director Centre for Economic and Policy Research (CEPR) in Washington, are even harsher in their warnings about the dangers of recessionary policies.27 Stiglitz and Baker highlight the difference between today’s inflation and that of the 1970s. Today’s inflation is primarily due to supply-side problems rather than increased demand. They point out that “with real consumption running at a normal level, there is little reason to believe that the US economy has a serious problem of excess demand. Making matters worse, higher interest rates and their effects on housing markets are likely to prove counterproductive.”

According to Stiglitz and Baker, “We should remember that today’s economy is very different from the economy of the 1970s. It would be the height of foolishness to graft 1970s solutions onto the problems facing us in 2022. The economy is very different: globalisation is more far-reaching and unions are significantly weaker. Accordingly, the debate should be turning to what else the government can do both to tame inflation and manage its most adverse effects, and to which political and economic ideas are most likely to guide us to the objectives we seek”.

The article ends on the following note: “Supply-side constraints call for supply-side solutions, many of which have yet to receive proper attention. Such measures would do as much to tame inflation as limited increases in interest rates would, and they would not come at the expense of workers and the broader economy. To address labour-supply issues, policymakers should be considering immigration reform, investments in childcare, a higher minimum wage, and legislation to make the workplace more attractive, especially to women and the elderly. To fix the housing sector, we need to encourage conversions of vacant office space into residential units. To tackle the energy crisis (and future ones), we need much greater public investments in green energy and government price guarantees on oil – a policy mix that would encourage production when there are shortages while still phasing out fossil fuels over the longer term. We also need stronger competition laws, so that firms don’t have an incentive to curtail production as a way to juice their profits.”

We can draw four main conclusions from the articles referenced here by Krugman, Stiglitz and Baker:

First of all, when it comes to economic policy making, it is not just what is happening in the field of the economy that is important, but also what policy makers think that is happening – maybe, on occasion, that’s even more crucial.

Secondly, there are several different estimates regarding the duration and character of rising inflation.

Thirdly, whatever the similarities and differences with the 1970s may be, the spectre of stagflation looms over the minds of those making critical decisions.

Fourthly, there is a visible risk of restrictive/recessional measures that will primarily affect the most financially vulnerable. This is of course the most important consideration.

Footnotes

- Flash estimate – June 2022 Euro area annual inflation up to 8.6%[↩]

- Hellenic Statistical Authority/ Consumer Price Index: June 2022, annual inflation rate 12.1%[↩]

- Adam Tooze Chartbook 127 – The World Bank’s global take on the 1970s, stagflation and debt crises[↩]

- European Investment Bank, The impact of the war on Europe’s economic recovery[↩]

- Eric Hobsbawm, The Age of Extremes: The Short Twentieth Century, 1914–1991[↩]

- Valentina Romei and Alan Smith, The global stagflation shock of 2022: how bad could it get?[↩]

- The World Bank, Global Economic Prospects[↩]

- Annual report of INE-GSEE 2022 – The Greek Economy and Employment (in Greek) [↩]

- Eric Hobsbawm, The Age of Extremes: The Short Twentieth Century, 1914–1991[↩]

- David Harvey, A Brief History of Neoliberalism, Oxford University Press, p. 21[↩]

- The World Bank, Global Economic Prospects, p. 54[↩]

- The World Bank, Global Economic Prospects, p. 58[↩]

- Eric Hobsbawm, as above[↩]

- Eugene Rogan, The Arabs – A History[↩]

- Alan S. Blinder, Economic Policy and the Great Stagflation, Academic Press, p. 25 – 27[↩]

- Andrew Glyn, Capitalism Unleashed: Finance, Globalization, and Welfare, Oxford University Press, p. 2[↩]

- Ibid, p. 25-27[↩]

- The World Bank, Global Economic Prospects, p. 58[↩]

- Eric Toussaint, The Mexican debt crisis and the World Bank[↩]

- Naomi Klein, The Shock Doctrine, Metropolitan Books[↩]

- David Harvey, A Brief History of Neoliberalism, Oxford University Press, p.16[↩]

- Larry Kramer, Beyond Neoliberalism: Rethinking Political Economy[↩]

- The World Bank, Global Economic Prospects, p. 59[↩]

- Sumathi Bala, Sri Lanka’s economic crisis deepens as the country is snowed under its crushing debt[↩]

- Devjyot Ghoshal και and Alasdair Pal Explainer: How Sri Lanka spiralled into crisis Explainer: How Sri Lanka spiralled into crisis | Reuters[↩]

- Paul Krugman, That Was the Stagflation That Was[↩]

- Joseph E. Stiglitz kai Dean Baker, Inflation Dos and Don’ts Inflation Dos and Don’ts by Joseph E. Stiglitz & Dean Baker – Project Syndicate (project-syndicate.org) [↩]