EU Tax Observatory & Eteron – New Research “A Modern Excess Profit Tax”

Eteron – Institute for Research and Social Change, is pleased to announce its collaboration with the European Tax Observatory, an independent research laboratory hosted at the Paris School of Economics directed by Gabriel Zucman, one of the world’s leading taxation experts and a close associate of Thomas Piketty.

To launch this collaboration, Eteron publishes the working paper “A Modern Excess Profit Tax”. Its authors are the EU Tax Observatory research team consisting of Gabriel Zucman, Bluebery Planterose, Carlos Oliveira and Manon François.

The study in question is essentially a proposal to tax the increase in market capitalisation of companies that are benefiting from exceptional circumstances, like for example energy companies after the invasion of Ukraine in February 2022.

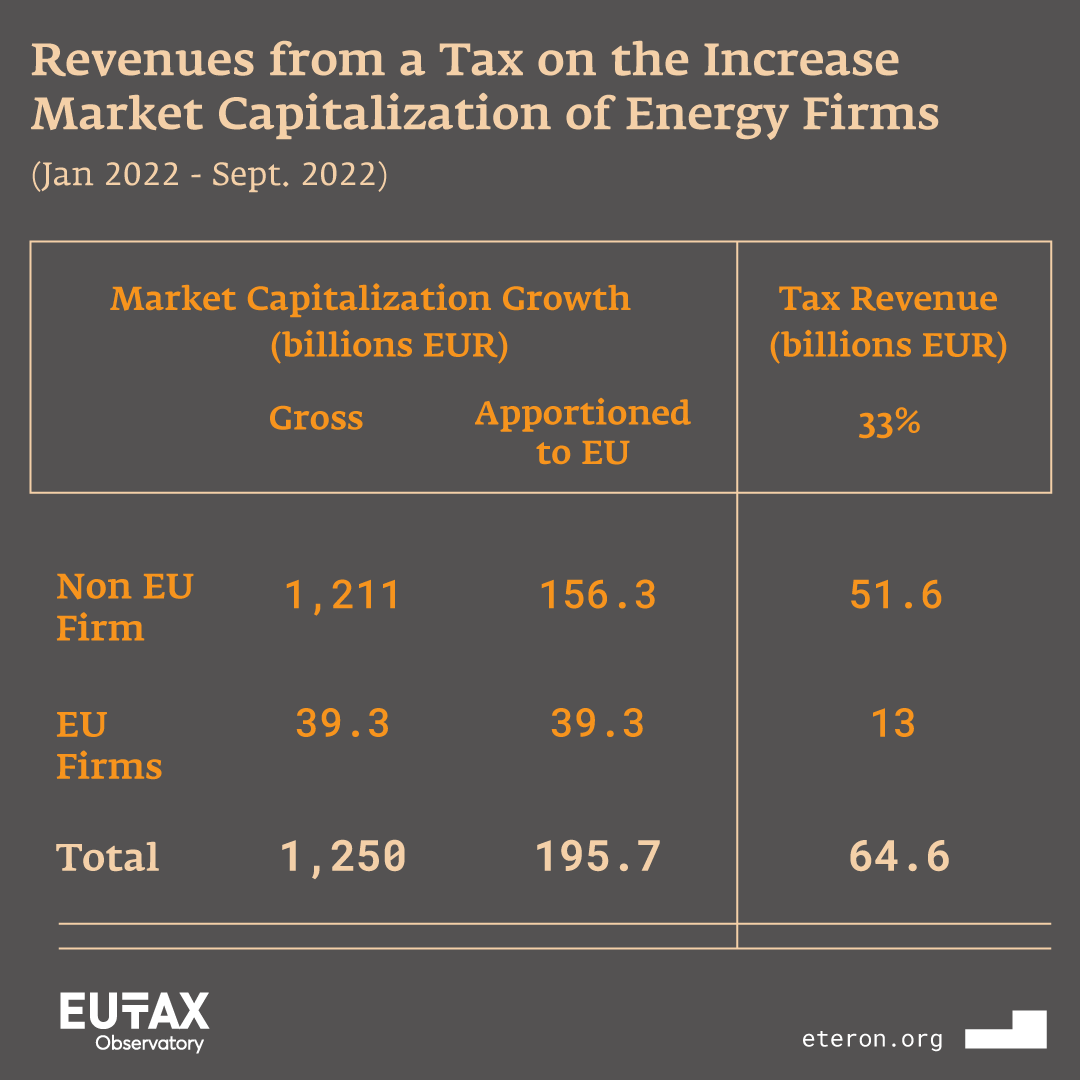

More specifically, the proposal is that all energy companies based or selling in the European Union should be subject to a tax of 33% on valuation gains if their capitalisation increased in 2022.

A 33% tax on the valuation gains of these energy companies between January 2022 and September 2022 would generate revenues of approximately €65 billion for EU countries (0.3% of GDP). In fact, if distributed in full and equally to all the EU households, this one-off tax could translate into €145 per person, i.e. almost €600 for a family of four.

The authors of the study state that the EU Tax Observatory’s proposal has two main advantages compared to traditional excess profits taxes:

First of all, since stock market capitalization is observable and hard to manipulate, the tax suggested would be easy to enforce. That is, companies would not be able to avoid it by shifting profits to tax havens.

Second, this tax would capture all rents earned by energy firms, including those earned from oil and gas extraction (upstream activities), as opposed to only rents on refining and other downstream activities.

This is in contrast to the excess profit taxes currently discussed in the European Union, such as the temporary solidarity contribution proposed by the European Commission in September 2022, which would tax profits booked in the European Union, i.e., primarily downstream activities. For a given tax rate, the excess valuation tax proposed by the EU Tax Observatory would generate about three times as much revenue as the solidarity contribution proposed by the European Commission: €65 billion vs. €25 billion with a tax rate of 33%, for example.

Finally, the fact that the proposed tax would apply to energy companies based or selling in the European Union means that such a mechanism would ensure a level playing field between EU and non-EU companies.

The tax proposal by Gabriel Zucman, Bluebery Planterose, Carlos Oliveira και Manon François, “A Modern Excess Profit Tax”, is available in pdf format.